Tapestry Inc. and Capri Holdings have officially terminated their $8.5 billion merger agreement. As the companies part ways, both are pivoting their strategies: Tapestry will focus on organic growth and shareholder returns, while Capri embarks on a turnaround plan that includes store closures and a marketing revamp for its flagship brands.

Challenges and Missteps

Capri CEO John Idol acknowledged significant missteps, particularly with Michael Kors and Versace. Revenues in the first half of the year fell 14.8% to $2.1 billion, with Michael Kors declining 15.2% and Versace dropping 22.1%. Idol attributed these declines to aggressive price hikes and delays in strategic planning caused by the pending merger.

At Michael Kors, efforts to elevate price points alienated core consumers, necessitating deeper discounts to maintain sales. To recover, the brand will focus on rebuilding its signature collections, streamlining its product lineup, and closing approximately 75 stores over the next two years.

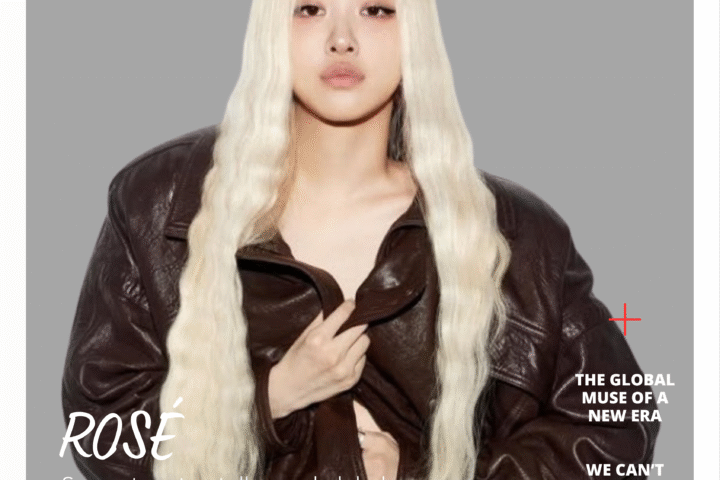

Versace faced similar issues, losing its aspirational customer base amid a global luxury slowdown. Idol said the brand moved “too fast” in its efforts to elevate, resulting in limited appeal across broader demographics. Capri now plans to inject “more energy” into Versace’s collections, balancing aspirational and high-end offerings.

Regulatory Roadblocks

The Federal Trade Commission (FTC) played a key role in derailing the merger. Concerned that combining the companies’ accessible luxury handbag brands—like Coach, Kate Spade, and Michael Kors—would stifle competition and lead to price increases, the FTC sued to block the deal. Although the case remained unresolved, the litigation extended past the merger’s February 2024 deadline, forcing its termination.

Future Plans

Capri aims to revitalize its core brands with a strategic overhaul. Marketing investments and a recalibration of pricing strategies are at the forefront of the company’s efforts to regain market share. Meanwhile, Tapestry is doubling down on organic growth and added $2 billion to its share repurchase plan. CEO Joanne Crevoiserat expressed confidence in Tapestry’s existing platform, stating the company is in “a position of strength” moving forward.

Market Response

While Capri’s shares rose 4.4% to $20.52 following the announcement, Tapestry’s stock surged 12.8% to $57.82, signaling relief among shareholders over the deal’s cancellation. Despite the costly and ultimately unsuccessful merger effort, both companies appear determined to forge ahead with renewed focus and strategic clarity.